Tender offers are an important financial move that can help reshape debt structure, optimize capital, and even boost bondholder value. This type of bond refunding has become popular with the elimination of tax-exempt refundings.

In this blog, I’m going to share how tender offer refunding works, the motivations driving issuers to refinance their bonds, and even discuss some challenges that may arise. I’ll also share a comprehensive financial analysis that sheds some light on the nuances of refinancing targeted tax-exempt bonds.

Bond Refunding Strategy Guide

Our step-by-step bond refunding strategy guide provides actionable insights into key refunding strategies, from tender offers to taxable advance refundings, equipping you with the knowledge to make informed decisions. Whether you're looking to restructure debt, free up budgetary capacity, or maximize savings, this guide will help you develop a refunding strategy that aligns with your organization’s financial goals.

What is a Tender Offer?

A tender offer occurs when an issuer invites a bondholder to either sell their bonds for cash or swap them for new bonds. Once bondholders respond that they are willing to sell their bonds, the issuer buys the bonds and removes the tendered bonds from their debt obligations. They can finance the tender offer with either new bonds or cash on hand.

Why Issuers May Refinance Bonds

Before we dive into tender offers, let’s discuss why an issuer may want to refinance their bonds in the first place. Municipal issuers have historically issued fixed rate long-term bonds during both low and high interest rate environments and sold the bonds with either a discount or a premium.

There are two main reasons why issuers want to refinance outstanding bonds:

1. Interest Rate Environmental Shifts

If interest rates or yields have dropped since the bond’s original issuance, the issuer would like to refinance, or refund, the bonds in a lower interest environment, thus reducing their future cash flow outlays and saving money.

2. Covenant Modification

The issuer needs to change a bond covenant of an outstanding bond (e.g., remove the requirement of a debt service reserve fund).

To refinance a bond, the issuer must “buy back” or redeem the original tax-exempt/taxable bond (i.e., the refunded bond) from the current bondholder. To finance the “buy back”/redemption, the issuer simultaneously sells a new tax-exempt/taxable bond (i.e., the refunding bond), unless they use cash, which is rare.

If the bond is callable (able to be paid off by the issuer prior to the bond’s maturity date), the issuer has the right to redeem the bond without the bondholder’s consent by using the bond’s call provisions.

Constraints on Municipal Bond Refunding

As stated in the “Advance Refundings - The Muni Gamble” blog, the current tax laws, specifically the 2017 Tax Cuts and Jobs Act (TCJA), restrict an issuer from using the bond’s call provisions to “buy back” or redeem a tax-exempt bond with new tax-exempt refunding bonds unless the call date is within 90 days of the issuance of the refunding bonds. This type of refunding is classified for tax purposes as a “current refunding.”

Let’s take a look at a few examples:

An outstanding tax-exempt bond matures on 1/1/2030 and is callable on 2/15/2024 at par.

- If the issuer wants to sell tax-exempt refunding bonds on 12/15/2023, the number of days until the outstanding bond is callable is 62 (<90 days so this would be a “current refunding”), using actual date count so this bond could be refunded with a tax-exempt refunding transaction.

- If the issuer wanted to sell tax-exempt refunding bonds on 10/15/2023, the number of days until the outstanding bond is callable is 123 (>90 days so this would be an “advance refunding”), using actual date count so this bond could not be refunded with a tax-exempt refunding transaction.

This restriction eliminates the issuer’s ability to replace an outstanding tax-exempt bond with a cheaper tax-exempt bond, aside from within the current refunding window, even though the current interest rates may be lower than the original interest rates and the issuer could save money.

Note: A taxable refunding bond’s proceeds can be used to call a tax-exempt bond even though the call date on the tax-exempt bond is greater than 90 days from the date of issuance (i.e., advance refunding). The higher yield on taxable bonds compared to tax-exempt bonds reduces the economics of the refinancing.

But what if the issuer tries to buy the tax-exempt or taxable bond in the general market like any other investor? This is the definition of a tender offer. The issuer goes into the capital markets and buys their outstanding bonds back at a low enough cost that when they issue a new tax-exempt refunding bond to finance the purchase of the outstanding bond, the issuer’s future cash flow is decreased, and the issuer saves money.

A tender offer purchase is classified as a “current refunding” for tax purposes, permitted under the TCJA. Once the bond is purchased and defeased by the issuer, the bond is no longer considered outstanding and the tendered bond’s debt service is removed from the issuer’s budget, and replaced with the refunding bond’s debt service.

Sample Tender Offer Refunding Transaction

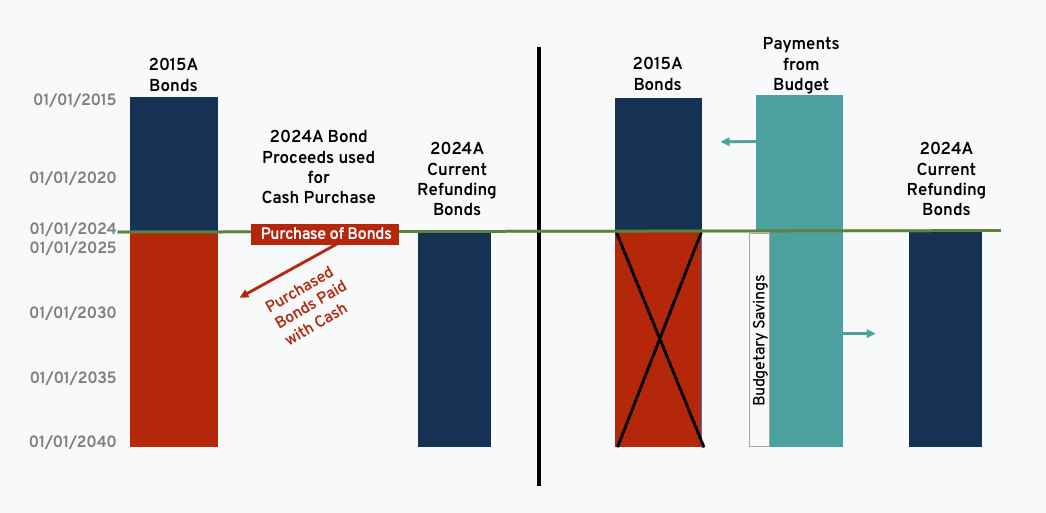

Now let’s say an issuer sold a 2015A bond deal on 01/01/2015, whose call date is on 01/01/2025. On 01/01/2024, the issuer initiates a tender offer for the 2015A bonds. This action is taken because the bonds cannot be refunded using tax-exempt bonds, given that the call date is 366 days away.

For this example, assume the issuer can purchase all the outstanding 2015A bonds. To finance the tender offer, the issuer sells 2024A tax-exempt bonds.

Note:

-

2015A bonds are purchased from the bondholders prior to the call date of 01/01/2025, on 01/01/2024.

-

There is no refunding escrow so the 2024A bonds are characterized for tax purposes as a “current refunding.”

In the diagram below, the issuer pays the blue sections with cash from the general fund (or debt service fund), and the red sections are paid off from the proceeds of the 2024A bonds starting on 01/01/2024.

If the issuer has excess cash on hand or has cash that is associated with the existing to-be-tendered bond issue, they can use that cash to partially finance the tender offer and reduce the amount of refunding bonds.

How a Tender Offer Works

Tender offers can be executed to:

-

Produce a lower debt service cash flow in the future for the issuer thus producing both economic and budgetary savings.

-

If the issuer previously sold taxable advance refunding bonds (permitted under the TCJA) to refund tax-exempt bonds and the refunded tax-exempt bonds have now been called, the taxable bonds can be converted to tax-exempt bonds by refunding the taxable bonds with a tender offer prior to their call date (see discussion of New York City transaction below).

-

If there are tax-exempt bonds with shorter than 10-year calls (e.g., 5-year calls), those bonds can be refunded with new tax-exempt bonds with longer calls (e.g., 10-year). This is a way to monetize the call value of the tax-exempt refunded bonds.

-

If the issuer has outstanding bonds that have a covenant that the issuer wants to immediately remove/change, they can do so by tendering for the bonds and replacing them with new bonds that either remove or change the covenant.

Additional participants in a tender offer:

1. Deal Manager: This is the firm running the tender offer. The deal manager of the tender can also be the underwriter of the refunding bonds. There is a deal manager agreement document that defines the role of the deal manager and their responsibilities.

2. Tender Agent: This is the firm that helps identify current bondholders, distributes the tender offer documentation, and works with Depository Trust Company (DTC) to receive and process tenders.

The tender is announced to the public through the invitation document. This document informs the bondholders that a tender offer is to be made and describes the rules (e.g., which bonds are the “targeted” bonds, the date the tender is to be executed, etc).

Once the invitation document is sent out, it can be amended or supplements can be added to better clarify the tender offer rules. The issuer can also voluntarily inform EMMA of the tender offer.

It’s important to remember that although there are no specific SEC rules governing municipal tender offers, when analyzing for anti-fraud considerations, most tax lawyers depend on the corporate tender regulation, 14E. This regulation outlines prohibited practices that any person making a tender offer should avoid.

Setting the Price of a Tender Offer

There are three methods when it comes to setting the price of a tender offer:

1. The issuer sets a price that meets their objective. This is known as the “savings percentage target.” The issuer then requests that anyone interested in tendering their bonds at the set price must contact the dealer manager.

2. The issuer announces a tender offer to the open markets. Owners of targeted bonds tell the issuer what price they will sell their bonds. The issuer uses a Dutch Action to review all the prices asked for by the bondholders, and decide the price point, if any, they are willing to purchase the targeted bonds that meet their financing objective.

3. The issuer informs the dealer manager to look in the open market for the targeted bonds. If the bond is available in the open market, the dealer manager buys the bond, typically at a price equal to or less than the issuer's set price.

Challenges When Executing a Tender Offer

1. The issuer must find as many of the current bondholders who hold the targeted bonds. The way bonds are held presents unique challenges. Some of the issues making it challenging to find bondholders are:

-

The bonds are freely tradeable (without consent).

-

The bonds are typically traded anonymously in electronic book entry form in clearing systems.

Unless bondholders proactively identify themselves to an issuer, the issuer might remain unaware of its “actual” investors. Both the tender agent and bondholder information firms (e.g., Ipreo) can help find the current bondholders. Historically, the issuer can only find approximately 40% of the bondholders (based on my personal history).

2. Since the execution of the tender is in the hands of the bondholder, the price the issuer is willing to pay for the targeted bond MUST be acceptable to the bondholder. Since the current bondholder is not looking to sell their bond (except in an extraordinary case such as an issuer being downgraded by a rating agency), they would want a profit, considering capital gains taxes, to sell their bond. The current yield of the bond plus the additional buyer’s price adjustment might also make the bond too costly to produce future cash flow savings.

There are many legal considerations when making a tender offer. If you are interested in that portion of the execution of a tender offer, please take time to listen to Orrick’s public finance webinar Municipal Tender and Exchange Transactions.

Real-World Example: New York City’s Successful Tender Offer

New York City, which offered a tender on its taxable fiscal 2021 bonds at the end of May 2023, joined other recent issuers opting to tender their bonds instead of engaging in a taxable refunding.

“The tender offering provided an interesting opportunity to get some value from taxable bonds issued to advance refund tax-exempt bonds,” said Jay Olson, New York City's Deputy Comptroller for Public Finance. New York City "received nearly 1,200 offers from bondholders during the tender process for a total of roughly $454 million, or 40% of the outstanding principal of the relevant bonds.” This was one of the city's most successful tender offerings to date in the muni market, saving the city $26 million of future debt service savings.

New York City successfully acquired bonds from individuals who put their tender offer at dollar prices that were significantly below the make-whole call floor price. This is where the savings were really generated — through the combination of low purchase price and then flipping from a taxable rate to a tax-exempt rate.

Read the full article at The Bond Buyer.

Financial Analysis of Refinancing Targeted Tax-Exempt Bonds

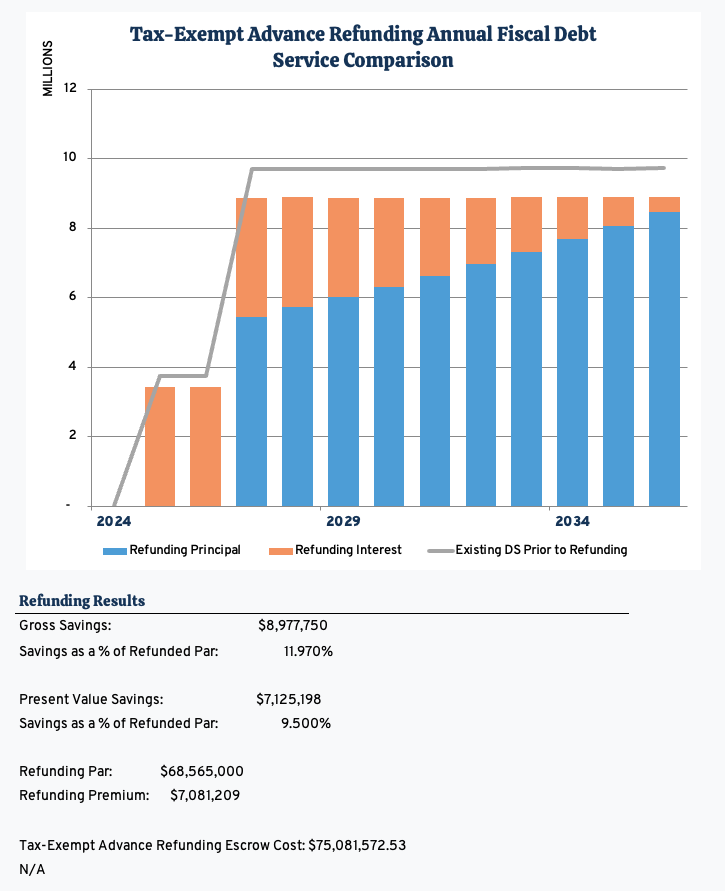

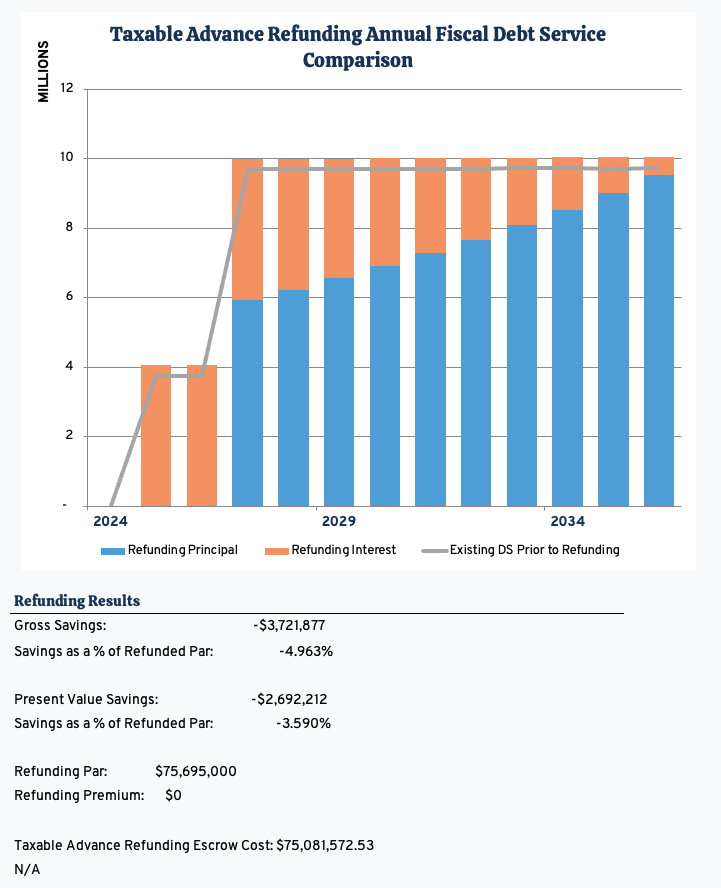

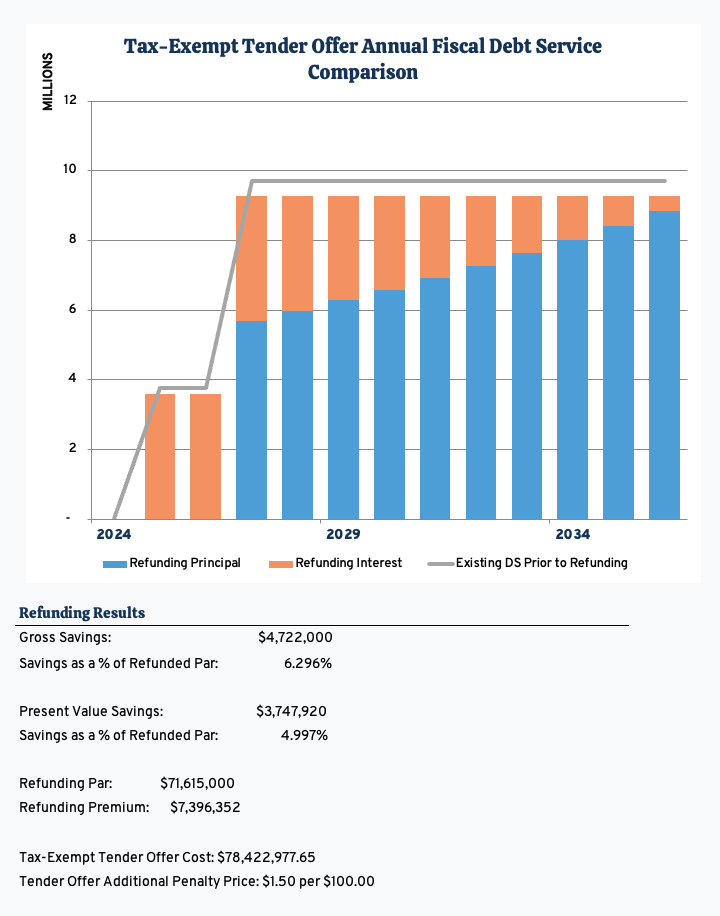

Below is a sample cash flow showing the economic comparison of refinancing targeted tax-exempt bonds with:

- A tax-exempt advance refunding (not permitted currently)

- A taxable advance refunding a tax-exempt tender offer

Analysis based on October 20, 2023 market rates.

Parameters of the tax-exempt tendered bonds:

- Originally issued: 02/15/2016

- Par: $75,000,000

- Maturities: 02/15/2027 – 02/15/2036 (5.00% coupon bonds)

- Bond Structure: Level Debt (approx.)

- Call Date: 02/15/2026 @ par

1. Parameters of the tax-exempt advance refunding bonds (not permitted currently):

- Issued: 02/15/2024

- Maturities: 02/15/2027 – 02/15/2036 (5% coupons, tax-exempt yield spreads)

- Bond Structure: Level Savings/Losses

- Bond Scale: Interpolated MMD Curve (no adjustments)

- Escrow Reinvestment Rate: SLGs Rate

- Call Date: 02/15/2034

2. Parameters of the taxable advance refunding bonds:

- Issued: 02/15/2024

- Maturities: 02/15/2027 – 02/15/2036 (par bonds, taxable MMD scale for yields)

- Bond Structure: Level Savings/Losses

- Bond Scale: Treasury Curve (no adjustments)

- Escrow Reinvestment Rate: SLGs Rate

- Call Date: 02/15/2034

3. Parameters of the tax-exempt tender offer bonds:

- Issued: 02/15/2024

- Maturities: 02/15/2027 – 02/15/2036 (5% coupons, tax-exempt yield spreads)

- Bond Structure: Level Savings/Losses

- Bond Scale: MMD (no adjustments)

- Escrow Reinvestment Rate: N/A

- Call Date: 02/15/2034

To summarize the examples above, on October 20th, if the issuer could find all of the target bondholders, and all holders were willing to receive $1.50 over the current price of the bond as profit for selling the bond, the tender offer would produce more savings than the taxable refunding to the issuer.

If legally permissible, the tax-exempt advance refunding would produce the second most savings while the taxable refunding would produce a loss to the issuer.

These results could easily change (except for executing a tax-exempt advance refunding) if:

- The spread between tax-exempt yield and taxable yields tightened.

- The bondholder would not sell their bond unless the additional profit was greater than $1.50.

- The issuer was unable to find all the bondholders or less than 100% of the bondholders elected to sell their bonds to the issuer thus reducing the savings/loss.

Municipal Debt Tender Offers Conclusion

As mentioned above, tender offers can be a vehicle to refinance outstanding bonds for either savings purposes or immediate covenant changes. Although the execution can be challenging, tenders are a method of buying the bonds back from the current bondholders and replacing those bonds with new bonds sold to finance the transaction (tax-exempt for tender, taxable for advance refunding).

Addendum - Diagrams associated with the New York City's taxable fiscal 2021 bond transaction:

Bonds Purchased | Bonds Sold | Accepted Invitation

Related Municipal Finance Reading

- DebtBook's Premium/Discount Amortization Methodology Explained

- Capital Financing Delay Tactics for Issuers Facing High Interest Rates

- A 'Game Changer' for the City of Memphis, TN

Disclaimer: DebtBook does not provide professional services or advice. DebtBook has prepared these materials for general informational and educational purposes, which means we have not tailored the information to your specific circumstances. Please consult your professional advisors before taking action based on any information in these materials. Any use of this information is solely at your own risk.

.jpg)

.jpg)

.jpg)